Why Do You Lose Child Tax Credit At Age 17 Expat Tax Online

You can claim the Child Tax Credit for each qualifying child who has a Social Security number that is valid for employment in. Can my Child Tax Credit be offset if my spouse or I owe past-due child support Added January 31 2022 Q A18. The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from 2000 to 3600 for. People with kids under the age of 17 may be eligible to claim a tax credit of up to 2000 per qualifying dependent. For tax year 2022 the child tax credit is 2000 per child under 17 whos claimed on your tax return as a dependent..

. . File your taxes to get your full Child Tax. The Child Tax Credit program can. ..

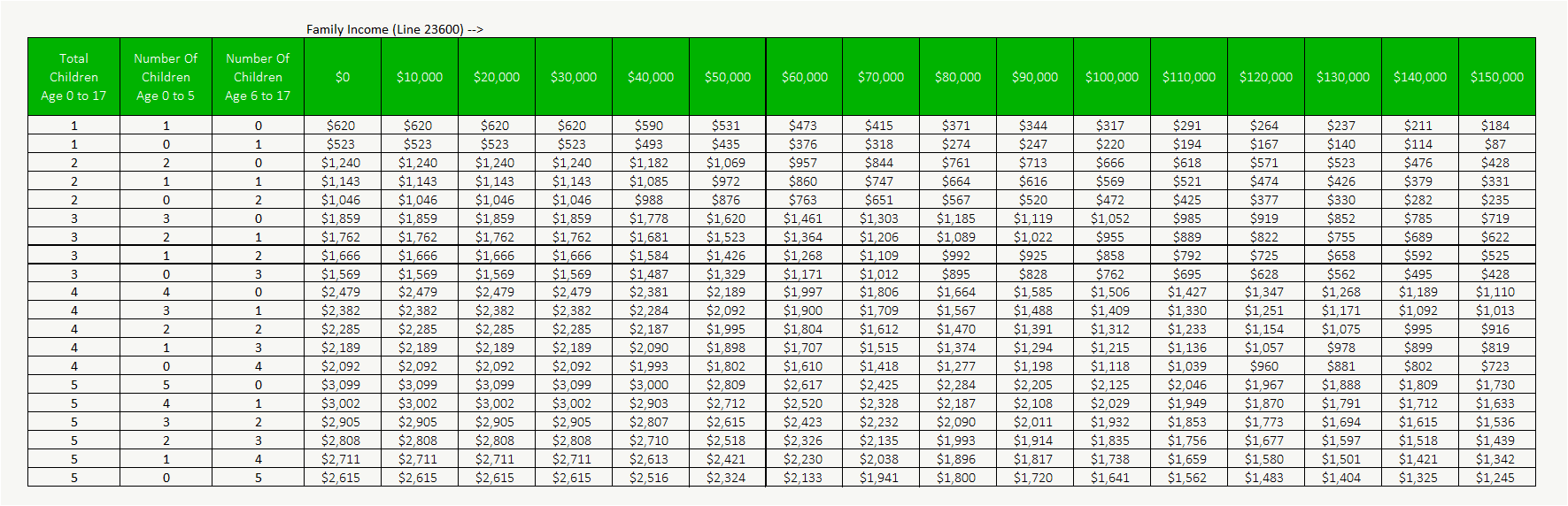

Canada Child Benefit Increase What Will Your Monthly Ccb Be Planeasy

Eligible families can now receive up to up to 5903 per child aged six through 17 and up to 6997 per child under the age of six for the July 2022 to June 2023 benefit year. For the period of July 2023 to June 2024 you could get up to 3173 26441 per month for each child who is eligible for the disability tax credit Go to Child disability benefit Repaying an. Canada child benefit CCB - calculation sheet for the July 2023 to June 2024 payments 2022 base year Alternative Format PDF 504 KB version You can also use the Canada Revenue Agency. For the period of July 2023 to June 2024 the maximum annual benefit per child under age 6 is 7437 61975 per month and the maximum annual benefit for children aged 6 to 17. Starting from July 20 2023 eligible families will receive higher Canada Child Benefit payment The maximum tax-free CCB benefit for each child under the age of six has been raised to 7437 per..

Key 2024 filing season dates Due date for 2023 fourth quarter estimated tax payments. These states plan to send child tax credit checks to families in 2024 Note that not all are fully refundable which means you may need an income to receive the full amount. More families could be eligible for the child tax credit as soon as 2024 if new legislation passes Congress IStock Congressional negotiators announced a roughly 80 billion deal. Best Mortgages for Small Down Payment Jan 16 2024 944 AM EST Sahil Kapur and Kate Santaliz Would enhance refundable child tax credits in an attempt to provide relief. For 2024 the credit is worth up to 7830 up from 7430 for 2023 with three qualifying children 6960 up from 6604 with two qualifying children 4213 up from..

Komentar